13 Best Budgeting Apps That Actually Save You Money in 2025

Look, I’ll be honest with you – hunting for the best budgeting apps that actually work has been eating at me for weeks. I mean, we’re all drowning in this financial mess, right? Turns out only 36% of Americans even have a written financial plan. That’s… kind of terrifying when you think about it.

But here’s what really got my attention – and maybe this’ll give you some hope too – about 96% of people who actually have a plan feel confident they’ll hit their financial goals. That’s huge! Makes you wonder what the rest of us are missing, doesn’t it?

So I dove deep into this whole thing. Forbes Advisor went through 38 different personal finance software options – yeah, thirty-eight! – and analyzed them across 18 data points to figure out which ones actually deliver. Part of me was skeptical, but then again… maybe some of these budgeting apps really can turn things around.

Most of them sync right up with your bank accounts automatically. No more scrambling through receipts or trying to remember where that $47 went last Tuesday, you know? And get this – tons of these free budgeting apps are completely free, while the premium ones only cost a few bucks monthly. They’ve got solid security too, which honestly was my biggest worry about connecting everything.

Here’s my thinking – decent budgeting software should save you time and help you make smarter choices with your cash. I’ve been losing sleep over this whole budgeting thing, tossing and turning, wondering if I’ll ever get my financial accounts straight.

My gut says some of these 13 best budgeting apps might actually be the answer. What’s the worst that could happen? Actually, don’t answer that – I don’t want to know! Let me walk you through what I found.

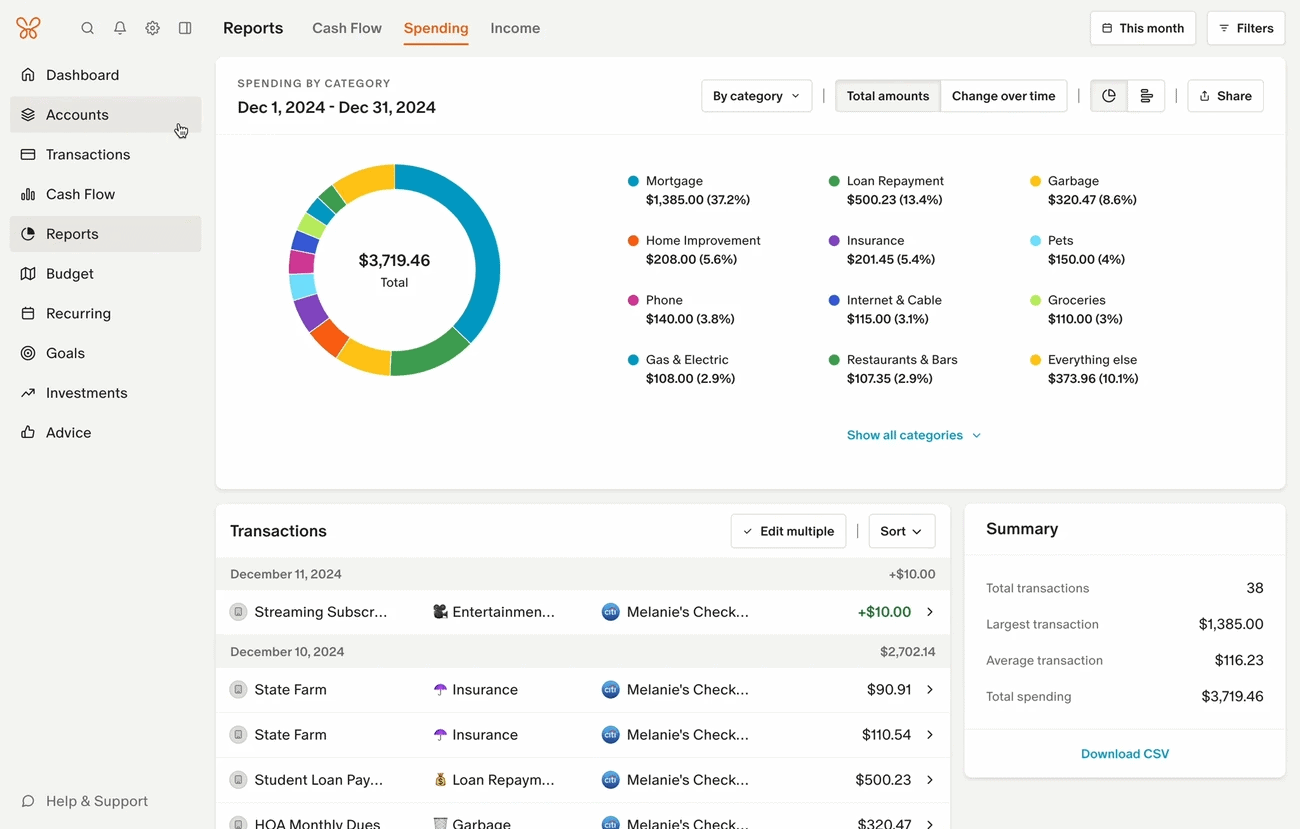

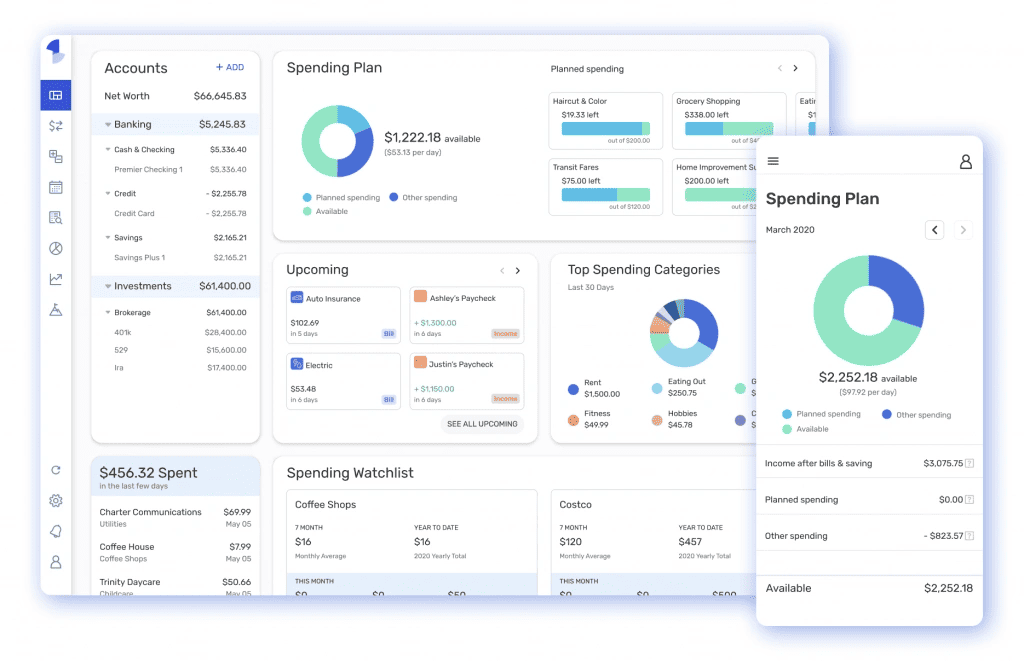

Best for ease of use: Monarch

Image Source: www.monarchmoney.com

Okay, so I spent way too much time testing Monarch – and honestly? It surprised me. This personal finance software just… works. Like, actually works without making me want to throw my phone across the room.

The interface is clean – no clutter, no ads screaming at you, just your monthly expenses laid out in a way that actually makes sense. Connects with over 13,000 financial institutions, which means it probably talks to your bank too, whatever weird credit union you’re stuck with.

Setting it up was weirdly painless. The app walks you through everything with these little visual hints that don’t make you feel like an idiot. And here’s something cool – it looks at your last two years of spending and suggests where to start your budget. Saves you from staring at a blank screen wondering what the hell you’re supposed to do next.

The dashboard thing is where Monarch really shines:

- You can customize everything to show what matters to you

- Zero ads – thank god, because I’m sick of apps trying to sell me stuff

- Charts that actually tell you something useful about your spending

- It sorts your transactions automatically, which saves me hours of tedious work

If you’re sharing money with someone else, Monarch gets it. Both of you can see the same picture without fighting over who gets to log in. Makes those “where did our money go?” conversations way less painful.

Setting up savings goals felt… satisfying? You can create as many as you want and watch them grow. The zero-balance budgeting means every dollar has a job – sounds intense but it’s actually pretty freeing once you get into it.

The bill tracking caught me off guard. It spots your recurring payments and shows them in a calendar view. No more surprise Netflix charges ruining your week, right?

People seem to love this thing – 4.9 stars on the App Store and 4.7 stars on Google Play. Costs $9.99 monthly or $8.33 if you pay yearly. Yeah, it’s not free, but… stranger things have happened than paying for something that actually helps.

The Sankey diagrams thing is pretty neat – shows exactly where your money flows each month. Kind of mesmerizing to watch, actually. Makes you realize where all those dollars sneak off to.

Monarch

Image Source: www.monarchmoney.com

Alright, so I spent way too much time digging into Monarch, and here’s what I found – this thing is basically trying to be your entire financial command center. Not gonna lie, that either sounds amazing or completely overwhelming, depending on how you look at it.

Monarch key features

First thing that caught my eye – Monarch connects to over 11,200 financial institutions. That’s… a lot. They use AI to figure out the best way to link each account, which honestly sounds fancy but I just want the thing to work, you know?

Here’s where it gets interesting though. You’ve got two ways to budget with this app. There’s the old-school category tracking where you monitor every little spending bucket. But then there’s this flex budgeting system that most people seem to prefer.

The flex approach just tracks the stuff that changes month to month – groceries, going out, entertainment. Way less complicated than trying to categorize every coffee purchase. Makes sense if you’re actually trying to save money instead of just obsessing over where every penny goes.

What really sets Monarch apart is how you can mess with your transactions. You can tie them to specific goals or even assign them to family members to review. That last part sounds either really helpful or like a recipe for arguments – depends on your relationship, I guess.

Oh, and it automatically spots your recurring bills and shows them on a calendar with reminders. No more surprise Netflix charges, which has definitely bitten me before.

Monarch pricing

Here’s where things get real – Monarch costs $14.99 monthly or $99.99 annually. That’s not cheap compared to other options.

No free version either, just a 7-day trial. They justify the price by saying you get premium features and zero ads.

I’ll give them this – they don’t sell your data to advertisers like the free budget apps do. Their whole business model is based on making features you actually want, not stuff that makes them ad money.

Monarch pros and cons

Pros:

Transaction management that actually makes sense with custom rules

- Those Sankey diagrams that show exactly where your money flows

- Partners can share accounts without paying extra

- Zero ads cluttering everything up

- Solid investment tracking if you’re into that

Cons:

- Costs more than most people want to spend

- Super short trial period

- No free option whatsoever

Monarch best use case

Honestly? This works best for couples who are serious about getting their money sorted together. The shared access without extra fees is pretty sweet.

If you want a comprehensive net worth tracker that handles everything – bank accounts, investments, real estate, cars, even crypto – Monarch’s got you covered.

Former Mint users seem to love it too. They get the same comprehensive feel but with better reliability and connections.

Bottom line – if you’re willing to pay for a premium experience and actually use all the features, Monarch could be worth it. But if you’re just starting out or want something simple, this might be overkill.

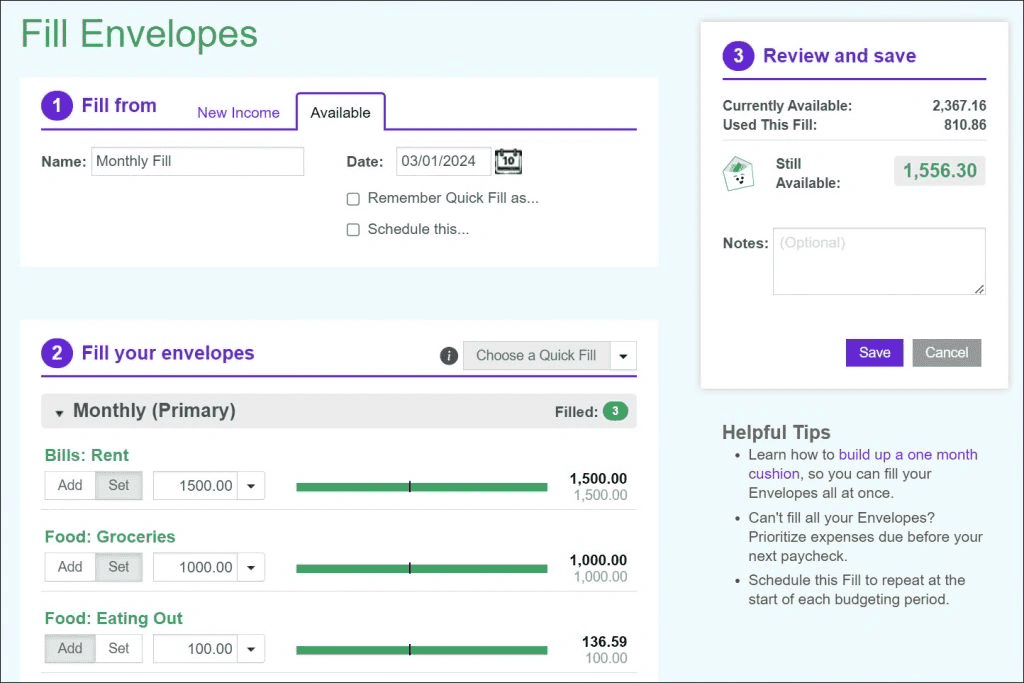

Goodbudget

Image Source: Goodbudget

Okay, so here’s something that caught my eye – Goodbudget takes that old-school envelope thing your grandmother probably did and makes it digital. You know, where you stuff cash into different envelopes for groceries, gas, whatever? Yeah, that… but on your phone.

Goodbudget key features

The whole setup revolves around these digital envelopes for your spending categories. You divvy up your money at the start of each month – groceries get this much, entertainment gets that much, you get the idea.

What’s kind of clever is they’ve got two special envelope types:

- Annual ones for those sneaky yearly expenses – like Christmas gifts that somehow always blindside you

- Goal envelopes for specific targets with deadlines you can actually set

They throw in spending reports and debt tracking tools too. Plus there’s educational stuff – courses on budgeting basics and getting out of debt.

Here’s the thing though – Goodbudget doesn’t automatically connect to your bank accounts like most apps do. You’ve got to manually punch in every transaction. Sounds tedious, right? But honestly, some people swear it makes them way more aware of their spending habits.

Goodbudget pricing

The free version gives you:

- 20 envelopes (split between monthly and annual)

- One financial account

- Works on two devices

- One year of transaction history

- Community support

The Plus plan runs $10 monthly or $80 annually and bumps you up to:

- Unlimited envelopes

- Unlimited accounts

- Five devices

- Seven years of transaction history

- Email support when things go sideways

Goodbudget pros and cons

Pros:

- Free version that’s actually usable

Simple approach that makes sense

- Share budgets across devices

- Manual entry forces you to pay attention

- Decent educational resources

Cons:

- Free version feels pretty limited after a while

- No automatic bank syncing unless you upgrade

- Manual entry requires serious discipline

- Missing some advanced features other apps have

Goodbudget best use case

This one’s solid for couples who want to stay in sync financially. Since budgets share across devices, your partner sees spending updates as they happen.

It’s perfect if you’re the type who likes planning ahead rather than just tracking where money went after it’s gone. The whole envelope approach without having to mess around with actual cash? That’s pretty smart.

Manual budgeters who want to develop better spending awareness will dig how the system forces you to engage with your finances regularly. It’s hands-on in a good way.

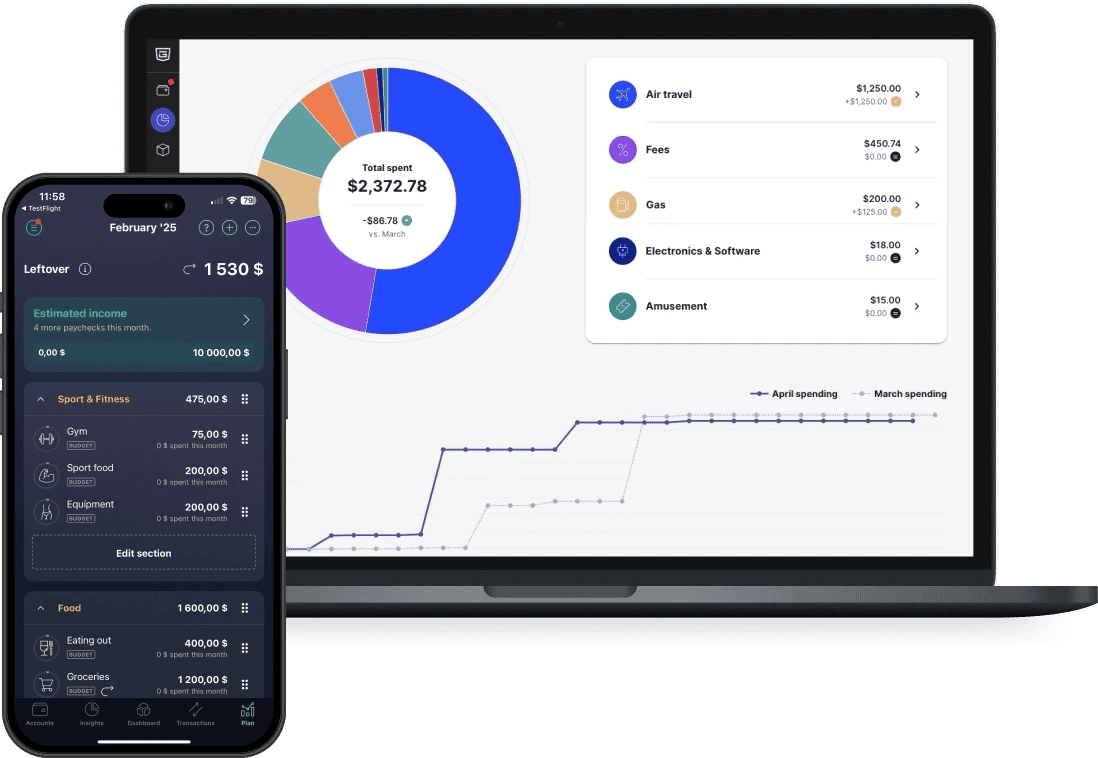

PocketGuard

Image Source: pocketguard.com

Okay, this one caught my attention right away – the PocketGuard app basically tells you exactly what you can blow today with their “In My Pocket” thing. I mean, how many times have you wondered if you can grab that coffee without screwing up your whole month?

PocketGuard key features

Here’s what got me excited – their “Leftover” feature does the math for you after bills, budgets, goals, and debts. It resets every month, which… honestly, that might save me from those random Amazon purchases at 2 AM, you know?

The app hooks up with over 18,000 financial institutions and throws your spending into these colorful pie charts. Actually, wait – I love pie charts. Makes it way easier to see where all my money’s disappearing to.

But here’s where it gets interesting:

- You can create custom #hashtags for tracking specific stuff

- Debt payoff planning that actually makes sense

- Alerts when you hit 50% of your budget – which is brilliant, right?

- Goal setting using that SMART framework everyone talks about

- They’ll even negotiate your bills for you

PocketGuard pricing

Three options here, and I’ll be straight with you about the costs:

Free version gives you basic stuff with some limits.

PocketGuard Plus runs $7.99 monthly, $34.99 annually, or $79.99 for lifetime access. That lifetime deal… I mean, if you’re planning to budget forever, it might be worth it? Gets you unlimited goals, custom categories, and that debt payoff planning.

PocketGuard pros and cons

Pros:

- Free version actually exists

- Those pie charts make everything crystal clear

- Catches bills and subscriptions automatically

- Leftover feature stops you from overspending

- Solid security with 256-bit SSL encryption

Cons:

- Free version is pretty limited

- Pricing gets weird across different platforms

- Won’t cancel subscriptions for you

- Their privacy policy lets them do partner marketing

PocketGuard best use case

Look, if you’re like me and sometimes go overboard with spending, this app might be a lifesaver. That Leftover number basically screams “STOP” before you mess up your budget.

Got credit card debt eating at you? Their payoff planning tool has helped people ditch more than $90 million in debt. That’s… that’s actually impressive.

And if you want the app to just handle the boring stuff automatically, PocketGuard figures out your recurring payments and schedules them for you. Less thinking, more saving – I can get behind that.

Honeydue

Image Source: App Store – Apple

Okay, here’s something that caught me off guard – the Honeydue app is specifically built for couples who want to tackle money together without the usual drama. I mean, how many relationships have you seen fall apart over money fights, right?

Honeydue key features

Here’s what got my attention about this whole setup. Honeydue links both partners’ accounts in one spot, but – and this is the smart part – you get to choose exactly what your partner sees. It connects to over 20,000 financial institutions across 5 countries, so chances are your bank’s covered.

The privacy thing is brilliant, honestly. You can share just your account balance, show all the transactions, or keep certain accounts completely private. Perfect for those “I bought myself something nice and I don’t want to explain it right now” moments, you know?

Bill reminders keep you both in the loop about what’s due when. No more “I thought you paid the electric bill” conversations.

But here’s my favorite feature – there’s actual chat built right into the app. You can comment on specific purchases or just drop an emoji reaction. Way better than that awkward “What was that $67 charge at Target?” text at 2 PM.

The app sorts your spending automatically into categories like “Shopping & Fun.” You can set monthly limits together and track how you’re both doing.

Honeydue pricing

This might be the best part – Honeydue is completely free. No tricks, no premium tiers, no “upgrade to see your own money” nonsense.

They do ask if you want to tip them occasionally, somewhere between a buck and ten bucks monthly. But it’s totally optional – no pressure.

Honeydue pros and cons

Pros:

- Built specifically for couples who want to work together

- Privacy controls let you choose what to share

- Built-in chat prevents those awkward money conversations

- Actually free – no hidden costs

- Bill reminders and spending alerts

Cons:

- Only works on mobile – no desktop version

- Pretty basic budgeting tools

- No savings goal features

- Budget tracking doesn’t roll over between months

Honeydue best use case

This works for couples at any stage. Just moved in together? Perfect. Married for twenty years? Also perfect. The key is it brings transparency without forcing you to merge everything.

If you want to see what your partner’s up to financially but still keep some independence, Honeydue nails it. You share what you want, keep what you want private.

Couples who end up arguing about money will love having a neutral space for these discussions. When you can comment directly on the transaction that’s bugging you, it cuts through a lot of the confusion.

Fresh couples just starting to figure out money together benefit huge from this collaborative approach. You get accountability without giving up your financial privacy.

Quicken Simplifi

Image Source: Quicken

You know what? I’ve been going back and forth on Quicken Simplifi for weeks now. There’s something about it that just… clicks differently than the others.

Here’s what caught my attention first – they don’t try to force you into some rigid budgeting box. I mean, thank goodness, right? I’ve been burned by apps that demand you follow their exact system or else.

Quicken Simplifi key features

The spending plan thing really got me thinking. It shows what you actually have left after your bills, subscriptions, and savings get their cut. Simple concept, but honestly? It’s kind of genius when you think about it.

They sync up with over 14,000 financial institutions – which, let’s be real, covers pretty much everyone unless you’re banking with some obscure credit union in the middle of nowhere.

What I found interesting is how it automatically spots your income, bills, and subscriptions. Saves you from that mind-numbing data entry, you know? Though part of me wonders if it catches everything… but then again, nothing’s perfect.

The savings goals feature lets you track whatever you’re working toward. Vacation, new car, emergency fund – whatever keeps you up at night wondering if you’ll ever afford it.

Their reports dig deep into your spending patterns. Sometimes that’s exactly what you need, sometimes it’s what you’re afraid to see. But hey, can’t fix what you don’t face, right?

There’s this refund tracker that tells you when expected refunds show up. Honestly, I never thought I needed this until I realized how many times I’ve forgotten about pending refunds.

Here’s something cool – you can share your account with your partner or accountant without them needing their own subscription. That’s… actually pretty thoughtful.

Quicken Simplifi pricing

Quicken Simplifi costs USD 3.00 per month when billed annually at USD 35.88. That’s with a 33% discount, which isn’t terrible.

They run promotions pretty often, sometimes dropping it to USD 2.99 monthly. Every little bit helps, I guess.

No free version, but they’ve got a 30-day money-back guarantee. At least they’re confident enough to put their money where their mouth is.

Quicken Simplifi pros and cons

Pros:

- Dashboard actually adapts to what you care about

- No ads cluttering up your financial life

- Solid transaction management with custom rules

- Plans ahead a full year

- Tracks investments pretty well

Cons:

- No free version to test the waters

- Forces you into annual billing

- Won’t hold your hand through debt payoff

- No trial period to figure out if you like it

Quicken Simplifi best use case

Here’s my take – Quicken Simplifi works if you want flexibility without chaos. It handles zero-based budgeting, envelope method, 50-30-20… whatever approach makes sense for your brain.

Couples seem to love the sharing feature since both people can access everything without paying twice. Smart move, honestly.

If you’ve got investments scattered everywhere, Quicken Simplifi pulls them together in one view. Makes you feel like you actually know what you own.

Former Mint users keep mentioning how easy it was to import their data. Since Mint’s gone, that’s probably a relief for a lot of people.

The visual reports apparently make spending patterns obvious. Sometimes you need those charts to smack you in the face with reality, you know?

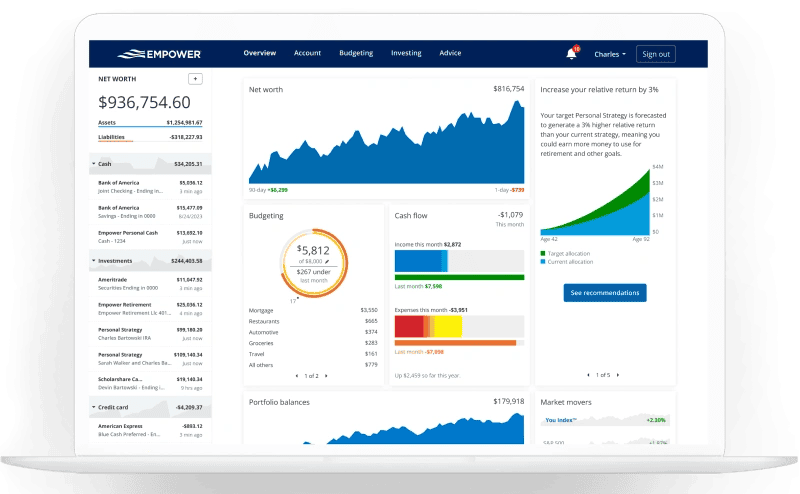

Empower

Image Source: Empower

Here’s the thing about Empower – it promises to show you everything, and I mean everything, about your money in one place. Part of me loves that idea, but then again… do I really want to see how messy my finances actually are?

Empower key features

Look, Empower doesn’t mess around. You can connect bank accounts, credit cards, investments, loans, even your house value from Zillow. The dashboard hits you with your net worth right up front – which honestly might be terrifying or encouraging, depending on your situation.

The cash flow monitoring thing automatically sorts your spending into categories. You can tweak these and add your own tags for better organization. I mean, at least someone’s organized around here, right?

But here’s where Empower really gets interesting – the investment tracking. You can dig into your portfolio allocation and spot those sneaky hidden fees in your retirement accounts. Those fees have been eating at my returns for years, and I never even knew it!

The retirement planner actually runs different scenarios – even simulates what happens if the economy tanks. Kind of morbid, but… stranger things have happened, and I’d rather know now than be surprised later.

Oh, and if you’re strapped for cash, they offer advances up to $300 with no interest or credit checks. Not gonna lie, that’s pretty tempting when you’re between paychecks.

Empower pricing

Here’s where my enthusiasm hits a wall – $8 monthly after a 14-day trial. Returning customers? They pay immediately, no trial period.

The subscription gets you all the budgeting and investment tools. You can email help@empower.me to opt out of the fee, but honestly, why would they make that easy?

Empower pros and cons

Pros:

- See everything in one place (scary but useful)

- Solid investment tracking and retirement planning

- They’ll reimburse overdraft fees if you prove it

- Cash advance payment extensions available

- No ads cluttering things up

Cons:

- That $8 monthly fee adds up

- Cash advances take forever (up to 5 days)

- Fast-funding fees are brutal ($1-$8 for advances up to $299.99)

- Basic budgeting compared to other apps

Empower best use case

Empower makes sense if you’ve got multiple investment accounts scattered everywhere. It helps track retirement savings and hunt down those fee vampires.

The cash advance feature works if you need quick money between paychecks. Just don’t expect it to be actually quick unless you pay extra.

Got $100,000+ in assets? You can get free calls with financial advisors. My gut says that’s where they really want you – the big fish with serious money to manage.

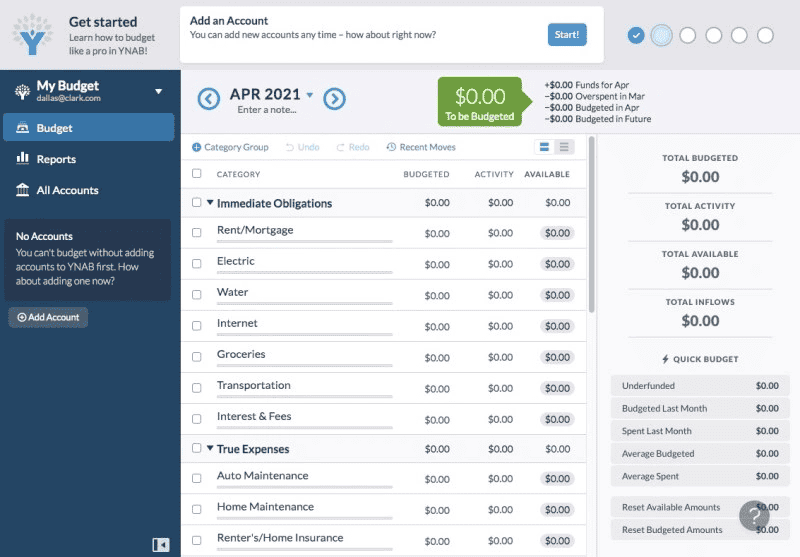

You Need a Budget (YNAB)

Image Source: Clark Howard

Okay, so here’s where things get… interesting. The YNAB app isn’t just another budget app – it’s like a financial boot camp. Built on a zero-based budgeting philosophy, this thing wants to rewire how you think about money entirely. Part of me finds that exciting, part of me finds it terrifying, you know?

YNAB key features

YNAB throws four rules at you right from the start:

- Give every dollar a job (zero-based budgeting)

- Embrace your true expenses (plan for infrequent bills)

- Roll with the punches (adjust when needed)

- Age your money (work toward spending last month’s income)

Now here’s something that caught me off guard – even though YNAB connects to major banks and credit cards, tons of users actually enter transactions manually. At first I thought, “Are they crazy?” But then… maybe there’s something to that hands-on approach.

The app starts you off with budget categories based on your lifestyle, but you can tweak these however you want. And if you’ve got a family situation going on, YNAB Together lets up to six people share the same account. That could either be amazing or a complete disaster – depends on your family, right?

YNAB pricing

Here’s where my wallet started getting nervous – YNAB costs $14.99 monthly or $109 annually (as of August 2024 for new signups). That’s… not exactly pocket change.

But they do give you a solid 34-day free trial, no credit card required. That’s actually pretty generous – gives you time to figure out if this whole system clicks for you. Oh, and college students get a free year with proof of enrollment. I wish I knew that back in the day!

YNAB pros and cons

Pros:

- Actually changes how you think about spending instead of just tracking it

- You can customize categories with emojis – which sounds silly but is oddly satisfying

- Free workshops and educational stuff if you’re into that

- Super flexible when you need to move money around

- Share with family at no extra cost

Cons:

- Learning curve is no joke – this isn’t plug-and-play

- Pricier than most alternatives

- No investment tracking or bill pay

- Demands regular attention – can’t just set it and forget it

- They keep raising prices

YNAB best use case

Look, YNAB isn’t for everyone. It’s for people who want to get their hands dirty with money management. If you’re looking for something that runs on autopilot, this isn’t it.

But if you’ve got irregular income – freelancers, I’m talking to you – YNAB might actually be a lifesaver. The flexibility handles those feast-or-famine cycles better than rigid monthly budgets.

Couples seem to love YNAB Together for collaborative budgeting. Though I imagine it could also lead to some… spirited discussions about spending priorities.

Here’s what got my attention though – average new users save $600 in their first two months and over $6,000 after one year. That’s real money. And users report feeling less stressed about finances overall.

My gut says YNAB is worth trying if you’re serious about changing your money habits. Just be prepared to actually do the work.

NerdWallet

Image Source: NerdWallet

Here’s the thing about NerdWallet – it’s kind of weird, you know? I mean, calling it a budget app feels… wrong. It’s more like having that friend who’s really good with money constantly whispering tips in your ear.

NerdWallet key features

So NerdWallet shows your credit score using TransUnion data. No dings to your score for checking – which honestly was a relief when I found out. I’ve been paranoid about that stuff.

The app does link up your accounts and shows spending patterns. Your net worth sits right there on the dashboard next to your monthly cash flow. Sometimes I wish it didn’t – ignorance was bliss, right?

The credit simulator thing is actually pretty cool. You can mess around with “what if I opened this credit card” scenarios without actually doing anything stupid. Wish I’d had this feature before some of my… questionable financial decisions.

But here’s where it gets frustrating – you can’t create custom spending categories or split transactions. I mean, come on! Sometimes I buy groceries AND household stuff in one Target run, you know?

The app does support that 50/30/20 rule everyone talks about. Fifty percent needs, thirty percent wants, twenty percent savings. Simple enough for someone like me who gets overwhelmed by complicated systems.

NerdWallet pricing

The basic version? Totally free. Credit score access, account linking, basic budget setup – all included.

NerdWallet+ costs $49 yearly and gives you this points system. Every 100 points equals a dollar, and once you hit 2,500 points, you can cash out. It’s like a game, but with your financial data.

NerdWallet pros and cons

Pros:

- Won’t cost you a penny for basic features

- Free credit monitoring (seriously, why isn’t this everywhere?)

- Tons of educational content

- No ads cluttering up your dashboard

- Decent security with two-factor authentication

Cons:

- More of a spending tracker than actual budgeting tool

- Can’t customize categories the way you’d want

- No transaction splitting capabilities

- Syncs once daily – can’t force it

- Those “helpful” product recommendations feel like ads anyway

NerdWallet best use case

Honestly? NerdWallet works great if you’re just starting out and everything else feels overwhelming. The interface doesn’t make you want to run screaming.

Credit score obsessives will love the free monitoring. That simulator feature helps you think through decisions before making them – something past me definitely needed.

The educational stuff is genuinely helpful. They cover everything from basic budgeting to investing basics. I actually learned things I didn’t know I needed to know.

Bottom line – NerdWallet’s solid for education and credit tracking, but don’t expect it to replace a real budgeting app. It’s more like financial training wheels, which might be exactly what some of us need.

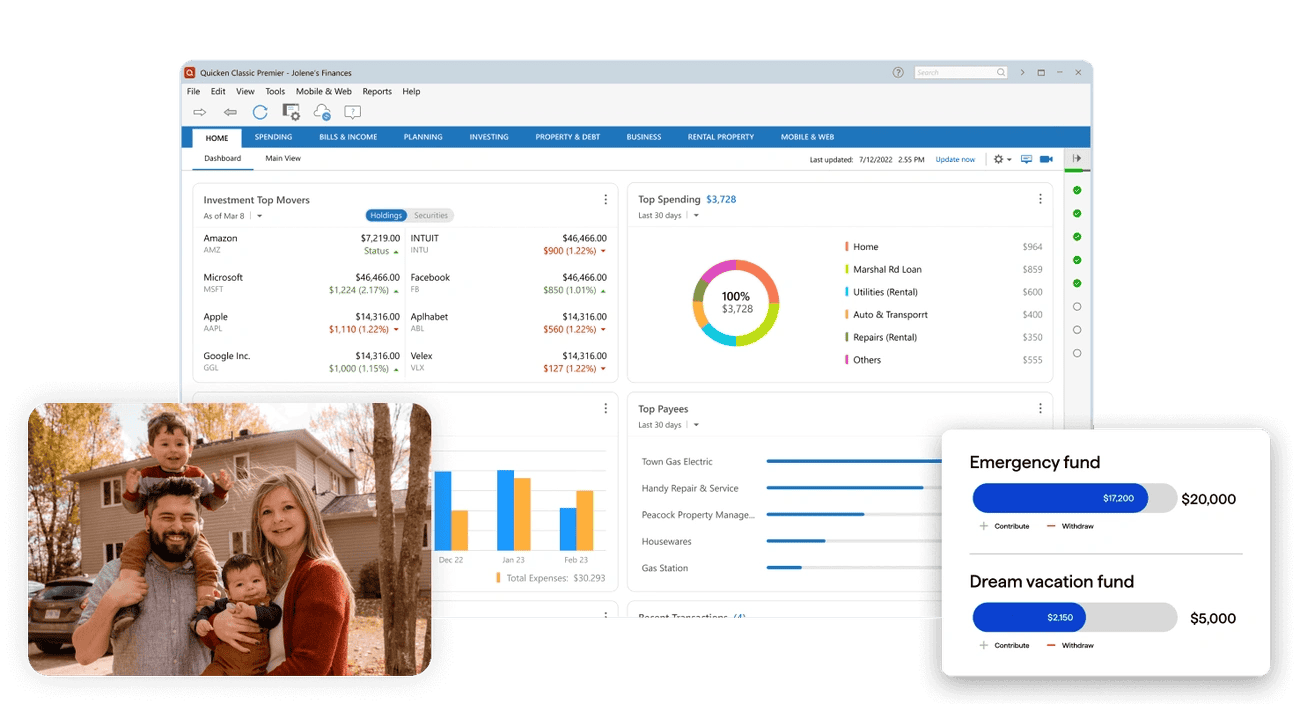

Quicken Classic

Image Source: Quicken

Okay, here’s the thing about Quicken Classic – it’s like that reliable old friend who’s been around forever and just knows what they’re doing. This desktop software has been in the game for decades, and honestly? Sometimes experience trumps flashy new features.

Quicken Classic key features

The Lifetime Planner is where Quicken really shows off. I mean, this thing helps you map out retirement, buying a house, having kids – all those big life moments that keep you up at 3 AM wondering if you’re prepared, you know?

What I love is that you can pay bills straight from the dashboard. Netflix, AT&T, your mortgage – boom, one-click payments. No more juggling multiple websites or forgetting due dates.

Everything lives in one place here. Bank accounts, investments, bills, credit cards – it’s like having a financial command center on your computer.

The investment tracking gets pretty detailed too. It digs into your portfolio, tracks deposits, generates reports… stranger things have happened than actually understanding where your money’s invested, right?

Business owners get some extra goodies with the Business & Personal version:

- Custom invoicing capabilities

- Keeps personal and business money separate (thank goodness)

- Property tracking through Zillow

- Tax prep help

- Tenant payment tracking

Quicken Classic pricing

They’ve got three tiers, and honestly, the pricing makes sense:

- Deluxe: USD 4.99/month (USD 71.88/year)

- Premier: USD 6.99/month (USD 95.88/year)

- Business & Personal: USD 9.99/month (USD 131.88/year)

Pro tip – wait for Black Friday sales and you can save 30-40% off these prices. My wallet definitely appreciates that kind of timing.

Quicken Classic pros and cons

What works:

- Everything in one comprehensive view

- That Lifetime Planner is seriously impressive

- Free bill paying with the Premier version

- They actually give you real onboarding support

- Tons of educational resources

What doesn’t:

- It’s desktop-focused, so mobile feels like an afterthought

- No double-entry accounting (sorry, accounting nerds)

- Won’t scale well if your business grows big

- No built-in tax filing

- Only works with U.S. and Canadian banks

Quicken Classic best use case

This is perfect for desktop users who have complex financial situations. Multiple accounts, loans, investments – Quicken handles it all without breaking a sweat.

Small business owners should definitely look at the Business & Personal plan. Being able to flip between business expenses and personal budgets in one place? That’s a game-changer when tax season rolls around.

If you’re someone who wants detailed reports and customizable breakdowns, Quicken delivers. It’s not the prettiest interface, but it gets the job done with decades of proven reliability.

Look, some people want the newest, shiniest app. But sometimes you just need something that works, has been working, and will keep working. That’s Quicken Classic in a nutshell.

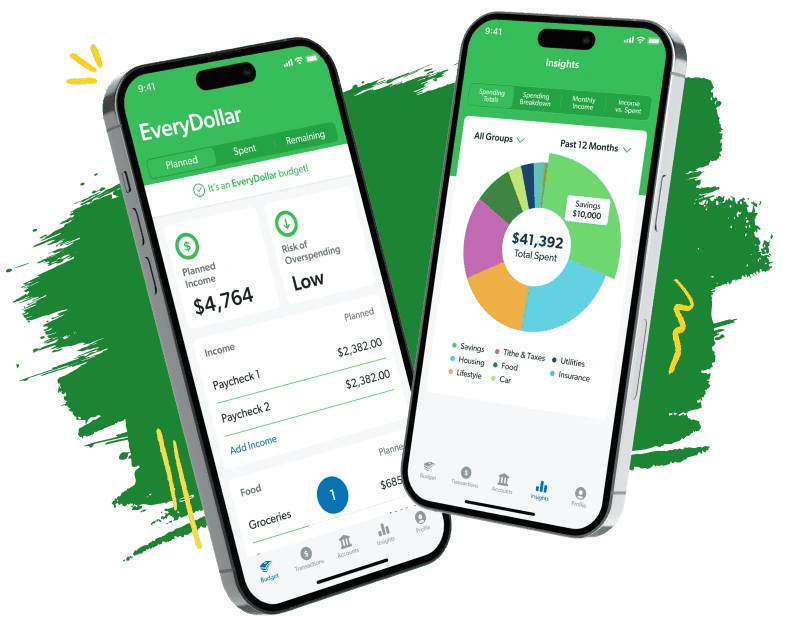

EveryDollar

Image Source: Ramsey Solutions

Okay, here’s the thing about the EveryDollar app – it’s Dave Ramsey’s baby, and you either love his whole philosophy or you don’t. Me? I’m somewhere in the middle, but I’ve got to admit this app makes zero-based budgeting feel… Well, less terrifying than it sounds.

EveryDollar key features

The whole idea is pretty straightforward – your income minus expenses should equal zero every month. Sounds impossible, right? But it’s actually about being intentional with every single dollar. No money just sitting around wondering what its job is.

You can create unlimited budget categories and – this part made me smile – add little emojis to them for some personality. Because who doesn’t want a pizza emoji next to their dining out budget?

Here’s where it gets interesting though. Premium users get automatic bank syncing, but free users have to type everything in manually. Part of me thinks that manual entry might actually be better for awareness, but then again… who has time for that?

The app throws in some solid extras:

- Bill reminders so you don’t get those lovely late fees

- Sinking funds for goals (smart move)

- Transaction splitting for the detail-oriented folks

- Paycheck planning if you go premium

- Reports that show where your money actually went

EveryDollar pricing

The free version gives you the basics with manual tracking. Not gonna lie, it’s pretty generous for a free app.

Premium runs $17.99 monthly or $79.99 annually (saving $135.89 per year). That’s… actually not cheap. But they do give you 14 days to test it out first.

There’s also this Ramsey+ thing for $129.99 yearly that bundles EveryDollar with Financial Peace University and coaching. If you’re all-in on the Dave Ramsey approach, might be worth it.

EveryDollar pros and cons

What I like:

- Interface doesn’t make you want to throw your phone

- Budget categories you can actually customize

- Premium members get coaching calls (that’s pretty cool)

- Perfect for beginners who need hand-holding

- Tons of educational stuff

What bugs me:

- Free version means typing everything manually

- Limited features unless you pay up

- No credit monitoring or retirement planning

- Premium only works in the US

EveryDollar best use case

Look, if you’re already drinking the Dave Ramsey Kool-Aid, this is a no-brainer. The app plays perfectly with his debt snowball method. I mean, it’s literally designed for that.

First-time budgeters will probably love this. The zero-based thing forces you to actually look at where your money goes instead of just… hoping for the best. Been there, done that, got the credit card debt to prove it.

Couples can share accounts and see the same budget, which is great for those “where did that $200 go?” conversations. Creates accountability without the drama.

And get this – average users apparently find an extra $395 in their first month and cut expenses by 9%. I mean, stranger things have happened, right?

Zeta

Image Source: YouTube

Okay, so here’s where things get a bit complicated – and honestly, it’s been bugging me. Zeta had this really smart take on couples and money, focusing on that whole “together but separate” thing that so many of us struggle with.

Zeta key features

Here’s what caught my attention about Zeta – it let both partners connect their accounts but you got to choose exactly what to share. Smart, right? No more awkward conversations about that random $50 charge.

The Goals feature was actually pretty clever. You’d set up shared savings targets, and Zeta would automatically create a plan to get there. Take some of the guesswork out of it, you know?

But what really stood out was this bill calendar thing. It would analyze your spending and suggest bills to add, then actually set money aside for them. Plus reminders when stuff was due – which, let’s face it, we all need.

The in-app messaging was genius too. Instead of texting your partner “What the hell was that $87 charge at Target?” you could just comment directly on the transaction. Way less confrontational.

They even had this Zeta Concierge service – basically a real person to help you set everything up. No extra cost, which was refreshing.

Zeta pricing

Here’s the thing that made me really interested – Zeta was completely free. No monthly fees, no minimum balances, none of that nonsense. They didn’t charge for:

- Opening or keeping an account

- Letting your account sit there unused

- Replacing a lost card

- Using their network ATMs

Sure, they’d hit you with fees for out-of-network ATMs and foreign transactions, but that’s pretty standard stuff.

Zeta pros and cons

Pros:

- Totally free – no hidden subscription costs

- Built specifically for couples dealing with money drama

- You control exactly what your partner sees

- Chat directly about transactions without the awkwardness

- Automatic bill detection and reminders

Cons:

- Savings goal tracking was pretty basic

- Needed regular babysitting to work properly

- Features kept getting cut

- And here’s the kicker – they’re shutting down

Zeta best use case

Zeta was perfect for couples who wanted to see each other’s money situation without merging everything. The privacy controls meant you could share what made sense and keep the rest private.

If you and your partner argued about money – and who doesn’t? – Zeta gave you a neutral space to hash things out. Comments right on transactions meant no more “I thought you said you weren’t going to buy anything” fights.

The bill tracking gave you both peace of mind, and the shared goals kept you accountable to each other.

But here’s where I have to break some bad news… Zeta announced they’re shutting down operations by May 9, 2025. Yeah, I know – just when you think you’ve found something good, right? Users need to close their accounts by that date.

Part of me is frustrated because this actually seemed like one of the better solutions for couples. But then again, maybe there’s a reason they couldn’t make it work financially. Still stings though.

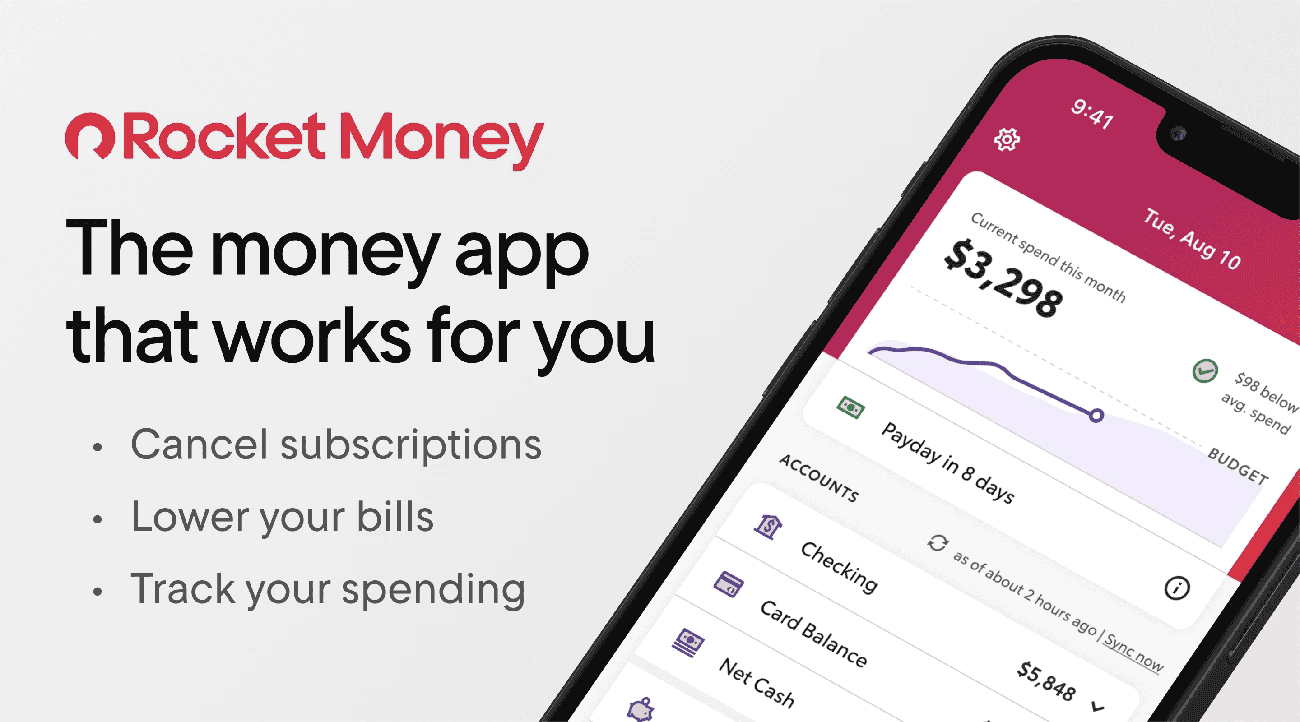

Rocket Money

Image Source: www.rocketmoney.com

Oh man, subscriptions… don’t even get me started. I swear these things multiply like rabbits when you’re not looking. That’s where Rocket Money comes in – they’re basically the subscription police you never knew you needed.

Rocket Money key features

Here’s what really caught my attention – Rocket Money actually hunts down all those sneaky recurring payments hiding in your spending. Finally, you can see every single subscription in one place with their due dates staring you in the face.

But wait, it gets better. Premium users can literally have Rocket Money cancel those forgotten subscriptions for you through their concierge service. No more awkward phone calls trying to cancel that gym membership you haven’t used since January!

The bill negotiation thing though… that’s where they really shine. These expert negotiators actually call your service providers – your internet company, phone carrier, all of them – and fight to lower your bills. I mean, who has time for that kind of haggling?

They’ve also thrown in some solid extras:

- Auto-sorting your transactions into categories

- Custom budget categories if you go premium

- Automatic savings goals that actually work

- Credit score tracking and reports

- Net worth monitoring across everything you own

Plus they’ll ping you when you’re about to blow past your spending limits. Pretty handy if you’re like me and lose track sometimes.

Rocket Money pricing

The free version gives you the basics – account linking, balance alerts, subscription tracking, and spending breakdowns.

Premium runs anywhere from $6-$12 monthly, and here’s the weird part – you pick what feels fair within that range. Everyone gets the same features no matter what you choose to pay. Honestly, that’s… refreshing?

New premium folks get a week to try everything out before committing.

Now here’s where it gets tricky – that bill negotiation service? They take 35-60% of whatever they save you in the first year. You choose the percentage, but still… that’s a decent chunk.

Rocket Money pros and cons

What’s working:

- Free version actually does useful stuff

- Finds those sneaky recurring bills automatically

- Handles the messy subscription cancellations for you

- Credit monitoring thrown in at no extra cost

- Shows you the full picture across all accounts

What’s not so great:

- Free version feels pretty limited once you get into it

- Those bill negotiation fees can really add up

- Need premium for custom budget categories

- Their privacy policy mentions partner marketing – ugh

- Some folks got hit with unexpected negotiation charges

Rocket Money best use case

This one’s perfect if you’re drowning in subscriptions and can’t keep track anymore. Rocket Money becomes your financial detective, sniffing out those budget-draining monthly charges you forgot about.

Hate confrontation? The bill negotiation service handles all that awkward haggling for you. Sure, they take their cut, but at least you don’t have to spend your afternoon arguing with customer service.

Budget newbies love how everything gets sorted automatically. Those colorful breakdowns make it crystal clear where your money’s disappearing each month.

And if you want the complete financial picture – spending habits, net worth, the whole nine yards – Rocket Money pulls it all together. No more jumping between different apps just to figure out where you stand financially.

Spendee

Image Source: www.spendee.com

Okay, here’s something that caught my eye – Spendee basically turns your budget into eye candy. This personal finance app doesn’t mess around with boring spreadsheets, you know? It’s all about those colorful charts that actually make you want to look at your money situation.

Spendee key features

You can set up different wallets for whatever’s going on in your life. Daily stuff, that vacation you’re planning, special events – each gets its own little financial space.

The multi-currency thing is pretty slick if you’re dealing with international money. No more trying to figure out exchange rates in your head while you’re traveling.

Here’s what I find interesting – with shared wallets, only one person needs to pay for the subscription. Everyone else can jump in for free. Smart move, honestly.

Premium users get to connect with over 2,500 banks, and the app handles all that transaction importing automatically. But even without premium, you can use labels to track stuff beyond basic categories – I mean, who doesn’t need to know exactly how much they spent on coffee this month, right?

Spendee pricing

The free version gives you the basics – one wallet, one budget, one label. Pretty limited, but hey, it’s free.

Spendee Plus runs $1.99 monthly or $14.99 yearly. You get unlimited everything but still have to enter transactions manually.

Premium bumps up to $2.99 monthly or $22.99 annually and adds that automatic bank sync. There’s even a lifetime option for Plus users who don’t want the bank connections.

Spendee pros and cons

Pros:

- Those charts are genuinely beautiful – makes financial stuff actually engaging

- Super affordable compared to most apps out there

- Categories with pictures and location tags? Pretty cool

- Shared tracking without everyone needing subscriptions

- Multi-currency support that actually works

Cons:

- Free version is pretty bare-bones

- Need Premium for bank syncing

- Zero investment tracking

- Some folks have sync problems with connected accounts

Spendee best use case

This is perfect if you’re one of those people who thinks better with visuals. I mean, some of us just need to see colorful pie charts instead of rows and rows of numbers, right?

Couples or roommates will love the shared wallet thing. Finally – transparency about who bought what without forcing everyone to shell out for subscriptions.

International travelers, this one’s for you. Track expenses across different countries without going crazy doing currency math in your head.

Most people find Spendee actually changes how they think about spending – turns out when you can see patterns clearly, you make better choices. Who would’ve thought?

Here’s What’s Really Going On – The Full Breakdown

Okay, so after digging through all these apps, my head’s spinning a bit. I mean, look at this mess of options! Part of me wishes someone would just tell me which one to pick, but then again… maybe seeing it all laid out like this will help both of us figure it out.

App Name | Monthly Cost | Key Features | Best Use Case | Notable Pros | Notable Cons |

|---|---|---|---|---|---|

Monarch | $14.99 | – Syncs with 11,200+ banks – Flex budgeting system – Transaction management – Recurring bill detection | Couples managing finances together | – Ad-free experience – Sankey diagrams – Partner sharing at no cost | – Higher price point – No free version – Brief 7-day trial |

Goodbudget | $10 | – Digital envelope system – Annual/Goal envelopes – Debt tracking – Educational resources | Couples wanting proactive budget planning | – Free version available – Simple approach – Cross-device sharing | – Limited free version – No auto bank sync – Manual entry required |

PocketGuard | $7.99 | – “Leftover” spending calculator – Syncs with 18,000+ banks – Debt payoff planning – Bill negotiation | Overspenders needing clear boundaries | – Free version available – Visual spending breakdowns – Auto bill detection | – Limited free features – Inconsistent pricing – Partner marketing allowed |

Honeydue | Free | – Links 20,000+ institutions – Privacy controls – Bill reminders – In-app chat | Couples seeking financial transparency | – Completely free – Custom privacy settings – Built-in chat | – Mobile-only app – Basic budgeting tools – No savings goals |

Simplifi | $3.00 | – Spending plan tool – Links 14,000+ banks – Savings goals – Refund tracking | Users wanting flexible budgeting approaches | – Customizable dashboard – Ad-free experience – Partner sharing | – No free version – Annual billing only – Limited debt planning |

YNAB | $14.99 | – Account sharing – Custom categories – Educational resources | Active money managers and irregular income earners | – Encourages awareness – Customizable categories – Free workshops | – Steep learning curve – Higher cost – No investment tracking |

Rocket Money | $6-12 | – Subscription management – Bill negotiation – Credit monitoring – Net worth tracking | Users with multiple subscriptions | – Free version available – Auto bill detection – Credit monitoring | – High negotiation fees – Limited free version – Premium required for custom budgets |

Spendee | $2.99 | – Multiple wallets – Multi-currency support – Shared expense tracking – Bank connectivity | Visual learners and international travelers | – Affordable pricing – Visual insights – Shared tracking | – Limited free version – Premium needed for sync – No investment features |

What strikes me looking at this whole thing is how different the pricing gets, you know? I mean, Honeydue’s completely free – which honestly makes me a little suspicious, but then again, stranger things have happened, right?

And then you’ve got Monarch and YNAB both charging fifteen bucks a month! My gut reaction was “that’s crazy expensive for a budget app,” but then I started thinking… Maybe that’s exactly what I need to take this seriously. Sometimes paying more makes you actually use something, doesn’t it?

The thing that’s really eating at me is this choice between free and paid. Part of me thinks I should start with the free ones and see what happens, but then another part worries I’ll just get frustrated with the limitations and give up entirely.

What’s the worst that could happen with trying the expensive ones first? Actually, don’t answer that – my credit card statement already knows!

Quick Comparison – What I Found

Alright, so after digging through all these apps, here’s what’s been rattling around in my head. My gut says you need to see this side-by-side before making any decisions, you know?

App Name | Monthly Cost | What Really Matters | Who Should Use It | The Good Stuff | The Not-So-Good |

|---|---|---|---|---|---|

Monarch | $14.99 | – Connects 11,200+ banks – Flexible budgeting – Transaction wizardry – Bill tracking | Couples who want to get their act together | – No annoying ads – Those fancy flow charts – Share with your partner for free | – Costs more than others – No free option – Trial’s pretty short |

Goodbudget | $10 | – Digital envelope thing – Yearly/goal envelopes – Debt help – Learning stuff | Couples who like planning ahead | – Free version exists – Simple to get – Works on multiple devices | – Free version’s pretty limited – No automatic bank stuff – You gotta enter everything manually |

PocketGuard | $7.99 | – Shows what you can actually spend – Links 18,000+ banks – Debt payoff help – Bill negotiation | People who spend too much (like me) | – Free version available – Pretty charts – Finds your bills automatically | – Free version’s kinda meh – Pricing’s all over the place – They might share your info |

Honeydue | Free | – Links 20,000+ places – Privacy controls – Bill reminders – Chat with your partner | Couples who want transparency | – Totally free – You control what you share – Built-in messaging | – Phone only – Basic budgeting – No savings goals |

Simplifi | $3.00 | – Smart spending plan – Links 14,000+ banks – Savings goals – Refund tracking | People who want flexibility | – Customizable dashboard – No ads – Share with partner | – No free version – Annual billing only – Limited debt help |

YNAB | $14.99 | – Zero-based budgeting – Account sharing – Custom categories – Learning resources | People who want to get serious | – Makes you think about money – Customizable everything – Free workshops | – Takes time to learn – Costs more – No investment tracking |

Rocket Money | $6-12 | – Subscription management – Bill negotiation – Credit monitoring – Net worth tracking | People drowning in subscriptions | – Free version available – Finds bills automatically – Credit monitoring | – High negotiation fees – Limited free stuff – Need premium for custom budgets |

Spendee | $2.99 | – Multiple wallets – Multi-currency support – Shared expense tracking – Bank connections | Visual people and travelers | – Cheap compared to others – Pretty visual insights – Shared tracking | – Limited free version – Need premium for sync – No investment features |

So Here’s What I’m Thinking…

Look, after all this research and losing sleep over which app to pick, I’ve got some thoughts. Part of me wants to just throw my hands up and go back to stuffing cash in envelopes, but then again… these apps might actually work.

Here’s the thing – finding the right budget app isn’t just about features or price. It’s about finding something that fits how your brain works, you know? What works for my neighbor might drive me absolutely crazy.

Monarch keeps catching my eye with its clean design and powerful features. Yeah, it costs more, but sometimes you get what you pay for. The ad-free experience alone might be worth it – I’m so tired of apps trying to sell me stuff when I’m just trying to figure out my finances.

But then again, if money’s tight (and let’s be honest, that’s probably why you’re looking for a budget app), Goodbudget or PocketGuard might be smarter choices. They’ve got decent free versions that could get you started without another monthly bill.

Couples have some solid options here. Honeydue being completely free is pretty amazing, and Zeta looked promising until… well, you know. Sometimes the universe has other plans.

YNAB keeps nagging at me because everyone says it actually changes how you think about money. That zero-based approach sounds terrifying and exciting at the same time. Maybe that’s exactly what I need?

And honestly? Visual people might love Spendee. Sometimes seeing your spending in pretty colors makes it easier to face the truth about where your money goes.

Here’s what really matters though – pick something you’ll actually use. I mean, the fanciest app in the world won’t help if it just sits there collecting digital dust on your phone.

My gut says start with a free trial when you can. Test it out for a few weeks and see if it clicks. Don’t just look at the features – pay attention to how it makes you feel about money. Does it stress you out more or give you some peace of mind?

Remember that whole statistic about 96% of people with plans feeling confident about their goals? That could be you. Stranger things have happened, right? Your financial future might just start with downloading the right app and actually using it.

What’s the worst that could happen? Actually, don’t answer that – let’s focus on the good stuff that might happen instead.

FAQs

Q1. What’s the best budgeting app for someone new to financial planning?

For beginners, apps like PocketGuard and NerdWallet are excellent choices. They offer user-friendly interfaces that make it easy to track spending without overwhelming users with complex features.

Q2. Is it necessary to pay for a budgeting app?

Not necessarily. Many budgeting apps offer free versions with basic features that can be sufficient for many users. Paid versions typically provide more automation and advanced tools, but they’re not always essential.

Q3. Are there budgeting apps designed specifically for couples?

Yes, several apps cater to couples managing finances together. Honeydue, YNAB, Zeta, and Monarch offer features that allow partners to share financial information and collaborate on budgeting.

Q4. How safe is it to use budgeting apps?

Most reputable budgeting apps prioritize security, using bank-level encryption and other protective measures to safeguard your financial information. However, it’s always wise to research an app’s security features before use.

Q5. Can using a budgeting app actually lead to savings?

Many users report significant savings after consistently using budgeting apps. The increased awareness of spending patterns often leads to better financial decisions, with some users saving hundreds of dollars within the first few months of use.