How to Build Wealth: A Proven Blueprint That Actually Works in 2025

Okay, so here’s the thing about building wealth – it’s been keeping me up at night, but not for the reasons you might think. I used to be terrified that I was missing some secret formula, you know? But then I realized… maybe it’s actually simpler than we make it out to be. Let’s dive into some proven ways to build wealth that can work for anyone.

Get this – if you just throw $1,000 into a decent , it grows to $53,700 over 40 years. I mean, that’s not chump change, right? Part of me thinks that sounds too good to be true, but then again… the math doesn’t lie. This is just one of many wealth creation strategies that can yield impressive results over time.diversified portfolio with a 10% annual return

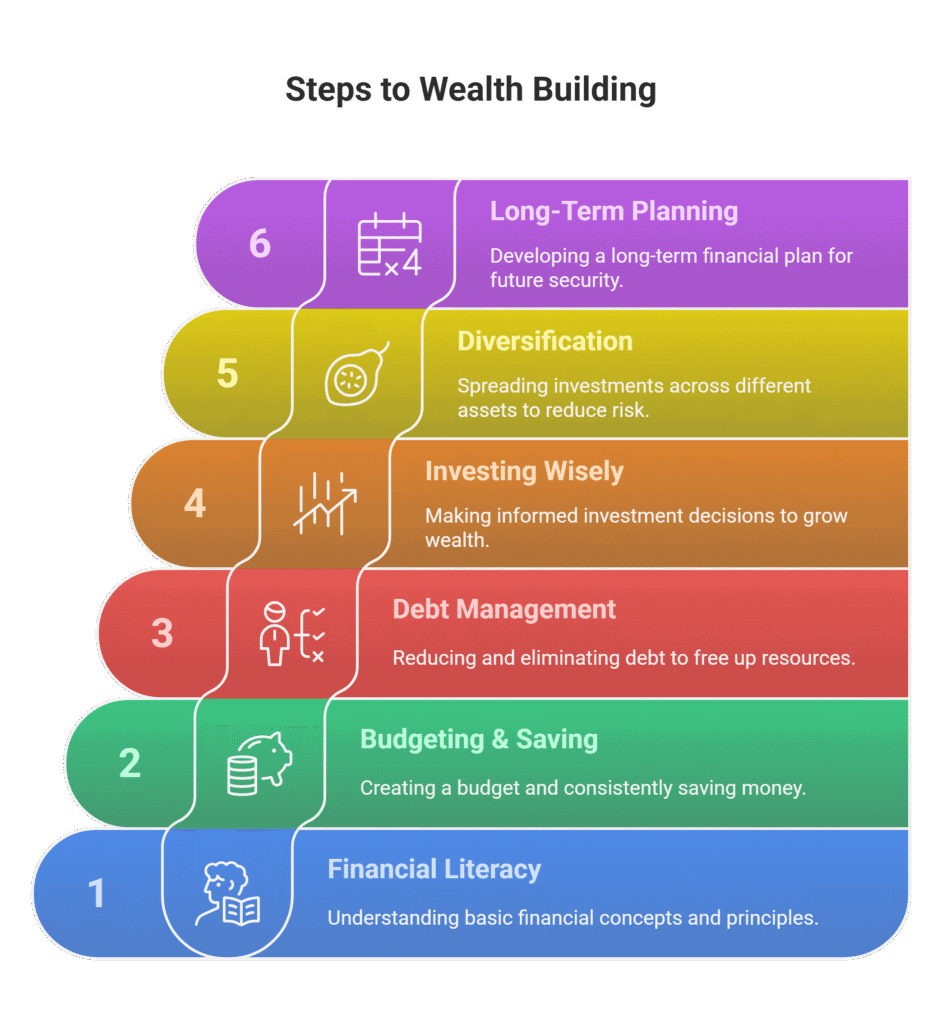

I’ve been digging into this stuff for years now, tossing and turning over spreadsheets and investment calculators. What I found is that wealth building really comes down to four basic things: earning money, saving it, investing it smartly, and protecting what you’ve built while not drowning in debt. Sounds obvious when I put it like that, but here’s the kicker – it’s not about getting rich quick. That’s the trap that gets most people.

You’re probably thinking you need to be making six figures to build real wealth, but hold on… that’s where things got interesting for me. of their income just eating out – 56% of us are hitting restaurants three times a week! I’m not saying you can’t enjoy a good meal, but what if we redirected even half of that money? The difference could be massive. This is where developing solid financial habits can really make a difference in your wealth accumulation strategies.The average American blows 10%

The experts keep saying invest 10-15% of what you make. Combine that with keeping three to six months of expenses tucked away for emergencies, plus using those high-yield savings accounts that actually pay you something decent – and suddenly you’ve got something solid to work with. These are fundamental steps to building wealth that often get overlooked.

My gut says this whole wealth-building thing is more doable than most people think. I’m going to walk you through what actually works in today’s crazy economy – from getting your foundation rock solid to making your money grow to keeping it safe once you’ve got it. These aren’t fancy tricks or get-rich-quick schemes… just practical steps that actually make sense for long-term wealth building.

Here’s Where You Actually Start Building Wealth

Alright, so you want to build wealth? Good. But here’s what I learned the hard way – you can’t just jump into investing and hope for the best. Trust me, I tried that approach… didn’t go well. Let’s talk about some essential wealth building habits that can set you up for success.

Track Where Your Money Actually Goes

This part used to drive me nuts, but it’s the foundation of everything else. You’ve got to know where every dollar is going – and I mean every single one. That morning coffee, your streaming subscriptions, that random Amazon purchase you forgot about… all of it. Budgeting for wealth starts with this crucial step.

Here’s what actually works: pick a rhythm that doesn’t make you want to quit. Some people track daily, others do it weekly, some even check before they leave the store. Find what sticks for you.

Those budgeting apps can be lifesavers – they connect to your bank, crunch the numbers automatically, and if you’re married, both of you can see what’s happening in real time.

Set Goals That Actually Mean Something

Look, vague goals are useless. “I want to be rich” gets you nowhere fast. You need both short-term wins and long-term vision working together. This is a key aspect of financial planning that many overlook.

Short-term stuff – things you can knock out this year – might be creating that budget, wiping out credit card debt, or setting up automatic savings.

Long-term goals? That’s your retirement, paying off the house, maybe saving for your kid’s college. These are all important steps to building wealth over time.

Make them specific. Make them measurable. Give yourself deadlines. This isn’t just feel-good motivation stuff – it actually keeps you focused when things get tough.

Build That Emergency Fund

This one’s non-negotiable, and I’ll tell you why. Life happens. Cars break down, medical bills show up, jobs disappear. Without an emergency fund, you’ll end up raiding your investments or going into debt when a crisis hits. This is a crucial part of asset protection and maintaining financial security.

Three to six months of expenses is the standard recommendation. If you’re self-employed or your income bounces around? Better make it closer to 12 months. Stick it in a high-yield savings account where you can actually get to it when you need it.

Figure Out Your Net Worth (Yes, Right Now)

Here’s the reality check most people avoid: your net worth is simply what you own minus what you owe. Assets minus liabilities. Bank accounts, investments, your house, even that car – those are assets. Credit cards, loans, mortgage – those are what you owe. Understanding how to increase net worth starts with knowing where you stand.

Grab a piece of paper and list it all out. Everything you own, what it’s worth, then subtract what you owe. The number might surprise you – could be better than you think, could be worse. Either way, now you know where you stand and can track if you’re actually making progress.

This isn’t about judgment – it’s about getting real with your starting point so you can actually build from here.

Okay, Here’s the Thing About Saving Money

“Do not save what is left after spending; instead spend what is left after saving.” — Warren Buffett, CEO of Berkshire Hathaway and one of the world’s most successful investors

This is where I have to get real with you – and myself, honestly. Consistent saving is what makes or breaks this whole wealth thing, and most of us are doing it wrong.

The of total income, about 5% below the decades-long average. That’s… not great. Let’s talk about some wealth building habits that can turn this around.personal savings rate in 2023 was just 3.8%

Just Automate the Damn Thing

I used to think I had willpower when it came to saving. Spoiler alert: I didn’t. Every month I’d tell myself “this time I’ll save whatever’s left over” and guess what was left over? Nothing. Zilch. Automated savings is a game-changer when it comes to investing for wealth.

Making savings automatic removes the temptation to spend. When money transfers automatically from your paycheck to savings, it becomes “out of sight, out of mind”.

Set up recurring transfers from checking to savings on payday, and you’ll build wealth without thinking about it.

Start by figuring out how much you can actually save based on your cash flow, then set up monthly or quarterly transfers.

Most experts say at least 10% of your monthly income. And if your employer offers matching for retirement? Take it. It’s literally free money – don’t be the person who leaves that on the table.

Actually Matter High-Yield Savings Accounts

Here’s something that genuinely shocked me – high-yield savings accounts can earn around 4%, while the national average is a pathetic 0.42%. I know, I know, it doesn’t sound like much, but hear me out. This is a simple yet effective wealth investing strategy.

$10,000 in a high-yield account earning 5% APY generates $500 in interest over a year. The same amount in an average account earning 0.45% gives you a whopping $45. That’s a $455 difference for doing absolutely nothing different except choosing a better account. Look for ones with no monthly fees and FDIC insurance up to $250,000.

Cut the Spending That’s Killing You

This part stings, but we need to talk about it. Pull up your year-end credit card statements – I’ll wait. Look for subscriptions you forgot about, all that takeout, impulse buys that seemed like good ideas at the time. Expense reduction is a crucial part of any wealth accumulation strategy.

Try setting a budget target 20-30% below what you spent last year in your problem areas. Remember how I mentioned Americans spend 10% of income eating out, with 56% dining out three times weekly? Even cutting that in half and investing the difference could change everything. This is where those financial habits we talked about earlier really start to pay off.

Zero-Based Budgets Work (Even Though They Sound Boring)

Zero-based budgeting means every dollar has a job. Your income minus expenses equals zero, with savings treated as a non-negotiable “expense”. This approach to budgeting for wealth can be a real eye-opener.

This forces you to actually think about your priorities each month and adjust when life happens. Instead of hoping there’s money left over to save, you’re saving first. It creates real intention with your money instead of just letting it disappear into who-knows-what.

Here’s Where Things Get Really Interesting – Making Your Money Work

Alright, so we’ve got the foundation stuff down, and you’re saving like a champ. But now comes the part that used to absolutely terrify me… investing. I mean, seriously, the whole stock market thing kept me paralyzed for years. What if I lose everything? What if I pick the wrong stocks?

But then I realized – and this might sound crazy – that NOT investing was actually the riskier move. Let’s dive into some wealth investing strategies that can help your money grow.

The Magic of (And Why It Blew My Mind)Compound Interest

Compound interest is like… okay, imagine you’re earning money not just on what you put in, but on all the money your money has already made. It’s wild. Check this out – a $10,000 investment at 7% would grow to about $76,123 after 30 years through compounding. Without compounding? Just $31,000. This is the power of long-term investing at work.

I nearly fell off my chair when I saw what happens if you start at 25 and invest $5,000 every year at 7%. By 65, you could be looking at around $1,068,048. I wish someone had shaken me by the shoulders and shown me this when I was younger, you know?

Don’t Put All Your Eggs in One Basket (Trust Me on This)

Here’s what I learned the hard way – spreading your money around actually makes everything less scary. A solid mix usually includes:

· Stocks for when you want things to grow

· Bonds for when you want to sleep at night

· ETFs because they give you instant diversification without the headache

· Mutual funds for professional management and diversification

Bond ETFs can be your friend here – they help keep things stable while potentially giving you better returns than just sitting in cash. Actually, let me be honest… I used to think bonds were boring. Turns out boring can be beautiful when the stock market’s having a tantrum. This diversification is a key aspect of wealth management tips that professionals swear by.

Max Out Those Retirement Accounts (Seriously, Do It)

This is where the government actually helps you out. For 2024, you can stuff away:

· $7,000 in IRAs ($8,000 if you’re over 50)

· $23,000 in your 401(k) ($30,500 if you’re over 50)

Someone putting in $7,000 plus that extra $1,000 catch-up contribution for 10 years with 6% returns ends up with $111,773. I mean… that’s not nothing, right? This is a prime example of how tax planning can boost your wealth creation strategies.

Index Funds: The Lazy Person’s Best Friend

I’ll admit it – I’m kind of lazy when it comes to picking individual stocks. Index funds are perfect for people like me. Vanguard’s expense ratios are 71% lower than the industry average, and get this – 83% of Vanguard’s index funds beat their competition over the past decade.

Fidelity even has some funds with 0% fees. Zero! As in, you keep everything you make. Sometimes I wonder what the catch is… but then I remember to just take the win. This approach to investing for wealth minimizes both effort and investment risk.

Reinvest Those Dividends (This One’s a Game Changer)

Instead of taking dividend payments as cash – and let’s be honest, probably spending them on something silly – let them buy more shares automatically. This is a key strategy for how to increase net worth over time.

Two people invest $7,700 in the same thing yielding 2.13%. One reinvests dividends, one takes the cash. After 25 years, the reinvestor had $49,368 MORE money. That’s like… a really nice car’s worth of difference just for clicking a button.

Actually, don’t answer this, but how many dividend payments have you probably blown on random stuff instead of reinvesting? Yeah, me too.

Alright, Here’s What Keeps Me Up at Night About Protecting Your Money

“You must gain control over your money, or the lack of it will forever control you.” — Dave Ramsey, Personal finance expert, radio host, and bestselling author

Honestly? Building wealth is one thing, but keeping it safe… that’s where I start getting really anxious. I mean, what’s the point of accumulating all this money if you don’t protect it properly, right? Let’s talk about some crucial wealth management tips and asset protection strategies.

Get the Right Insurance Coverage

This insurance stuff used to make my head spin, but here’s what I figured out – as your wealth grows, your basic policies just don’t cut it anymore. You need that seat on top of your regular auto and home policies for extra coverage. Trust me on this one.umbrella liability insurance

If you’ve got a nice house, are those standard homeowner’s policies? They’re probably leaving you exposed. You need specialized high-value coverage that actually protects your collectibles and expensive stuff.

And here’s something most people don’t think about – if you have household help, even part-time, you might need workers’ comp insurance. Many states actually require it for domestic employees. Plus, with all these cyber attacks targeting wealthy folks, cyber insurance isn’t optional anymore. These are all crucial aspects of asset protection that can safeguard your wealth.

Minimize Taxes With Smart Planning

like 401(k)s, IRAs, and HSAs can save you massive amounts over time. The Roth conversion strategy? That’s where things get interesting – especially in early retirement before those Required Minimum Distributions kick in. We’re talking six-figure savings. Effective tax planning is a key component of any comprehensive wealth management strategy.Tax-advantaged accounts

Here’s something that’s got me worried though – the federal lifetime exemption is $13.99 million per person ($27.98 million for couples) in 2025, but it’ll probably drop to around $7 million in 2026. Time’s ticking on this one.

Use Estate Planning to Build Generational Wealth

Estate planning makes sure your wishes actually get followed and your taxes stay low. Trusts can protect your assets from creditors and messy divorces. Generation-skipping trusts? They let you pass money to beneficiaries at least 37.5 years younger without getting hit with federal estate taxes twice. This is long-term wealth building at its finest.

Monitor and Improve Your Credit Score

Your credit score affects everything – borrowing costs, opportunities, you name it. Payment history is 35% of your FICO score, so pay those bills on time. Keep your under 30%. And don’t close those old accounts – length of credit history matters for 15% of your score. A good credit score is an often overlooked asset that builds wealth indirectly by saving you money on interest and opening up financial opportunities.

Teach Your Family How to Handle Money

This one really gets to me… financial education needs to start when kids are young. I’ve found that quarterly family meetings work best for discussing money management – it’s the best way to get the next generation involved while staying true to your family values.

You want to teach both the practical stuff (managing finances) and the emotional side (how to have a healthy relationship with money). This helps kids become good stewards of what you’re building for them. It’s about creating a legacy of financial security that lasts for generations.

What scares me most? All the wealthy families that fall apart because nobody taught the kids how to handle money responsibly. Don’t let that be your family.

Here’s What I Really Think About All This

Honestly? I used to overthink this whole wealth thing until my brain hurt. But after diving deep into all these numbers and strategies… it’s not as complicated as I made it out to be.

The thing is, we covered a lot of ground here – getting your foundation solid, saving smart, making your money work for you, and protecting what you build. I mean, it sounds like a lot when you list it all out, but each piece actually builds on the last one, you know?

Warren Buffett was onto something with that “save first, spend what’s left” thing. And that compound interest magic we talked about? That $1,000 turning into $53,700 over 40 years – that’s real. But here’s what keeps me grounded: it only works if you actually stick with it. These wealth accumulation strategies aren’t just theories – they’re proven methods that work over time.

Part of me wants to tell you to start big and go all-in, but then again… maybe that’s exactly the wrong advice. Start small. It starts to get messy. Start with whatever you’ve got right now. Even cutting back on some of those restaurant trips we mentioned and throwing that money into investments – stranger things have created wealth, right? It’s all about developing those wealth building habits that compound over time.

What really gets to me is thinking about all the people who never start because they think they need everything perfect first. The foundation, the emergency fund, the perfect investment strategy… Look, you can work on all of that as you go. Financial planning is an ongoing process, not a one-time event.

My gut says the hardest part isn’t learning what to do – we just covered all of that. The hardest part is actually doing it when Netflix is calling and your friends want to grab dinner for the third time this week. It’s about making those small, consistent choices that align with your long-term wealth building goals.

But here’s the thing that finally clicked for me: your future self is counting on the decisions you make today. Not tomorrow, not next month when you “get your act together” – today. Every step you take towards building wealth, no matter how small, is a step towards greater financial security and freedom.

So what’s it going to be? What’s the one thing from all this that you’re actually going to do? Actually, don’t tell me – tell yourself. Then go do it. Your wealth creation journey starts now.

FAQs

Q1. How much should I save each month to build wealth?

Financial experts generally recommend saving at least 10-15% of your monthly income. However, the exact amount depends on your individual financial goals and circumstances. Start with what you can afford and gradually increase your savings rate over time. This is one of the fundamental steps to building wealth.

Q2. What’s the best way to start investing for wealth as a beginner?

For beginners, a good starting point is to invest in low-cost index funds or ETFs that track broad market indices. These provide instant diversification and typically have lower fees than actively managed funds. Consider opening a retirement account like a 401(k) or IRA to take advantage of tax benefits. Mutual funds can also be a good option for those seeking professional management.

Q3. How important is an emergency fund in wealth building?

An emergency fund is crucial for protecting your wealth-building progress. Aim to save 3-6 months of essential expenses in a readily accessible account. This buffer helps you avoid dipping into investments or taking on debt when unexpected expenses arise, which is a key aspect of financial security.

Q4. Can I build wealth if I don’t have a high income?

Yes, you can build wealth even without a high income. The key is to focus on consistently saving and investing a portion of what you earn, no matter how small. Cutting unnecessary expenses, automating your savings, and making smart investment choices can help you grow wealth over time. Income increase strategies can help, but expense reduction is often more immediately achievable.

Q5. How does compound interest contribute to wealth building?

Compound interest is a powerful force in wealth building. It allows you to earn returns not just on your initial investment, but also on the accumulated interest over time. This effect can significantly accelerate your wealth growth, especially over long periods. For example, a $10,000 investment at 7% annual interest would grow to approximately $76,123 after 30 years through compounding. This is why long-term investing is so crucial for building substantial wealth.