What is Personal Finance? A Simple Guide That Actually Makes Sense [2025]

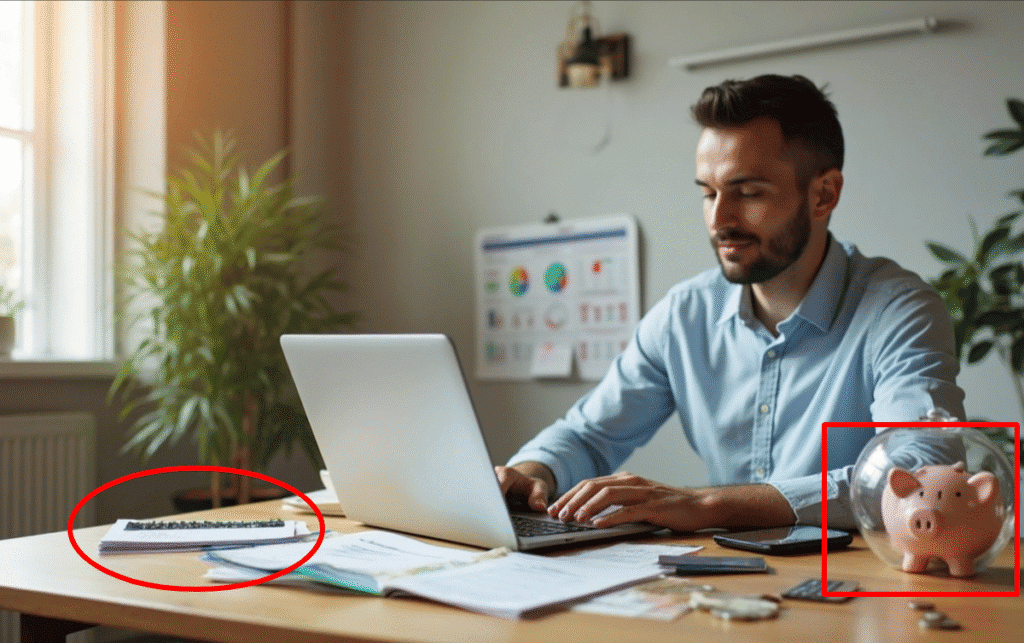

Personal finance management has made me wonder countless times about its true meaning. Money management helps you achieve your goals – from retirement planning to saving 50 euros each month for something special. This guide to personal finance 101 will help you understand the basics and importance of personal financial planning.

Money matters can feel overwhelming. Research shows financial stress tops the list of adult concerns and triggers anxiety, sleepless nights, and depression. Your nighttime money worries are shared by many others. Understanding the impact of financial stress on mental health is crucial for overall well-being.

The numbers tell a striking story. Household debt surged $3.8 trillion since December 2019, according to the Federal Reserve Bank. Credit card balances rose by $24 billion while student loans added another $21 billion. These figures paint a daunting picture of the financial struggles many face.

Money management doesn’t need complex strategies. Your financial life spans from simple to banking choices, insurance coverage to investment decisions. A solid grasp of these fundamentals helps channel your income toward major life goals like homeownership or your children’s education.budgeting

Let me explain what personal finance means without the confusing terminology that makes most people’s eyes glaze over. You’ll discover practical personal finance tips and money management strategies to take charge of your finances effectively.

Start with the basics: what personal finance really means

Personal finance includes everything about managing your money throughout your life’s trip. Your daily budgeting habits and long-term financial planning help you take control of your money and create a roadmap for your future.

What is the definition of personal finance?

Personal finance shows how you manage your individual or household finances to reach specific financial goals. It covers making money, saving it, growing wealth, and protecting your assets. Think of it as your relationship with money—how you earn it, spend it, save it, and make it work for you over time.

The concept goes beyond knowing what to do with your paycheck. Personal finance has:

- Income management (earning money)

- Spending decisions (using money)

- Saving strategies (setting money aside)

- Personal finance investing approaches (growing money)

- Protection methods (safeguarding assets)

Financial experts say personal finance is only 20% head knowledge and 80% behavior. The hard part isn’t understanding money management principles—it’s applying them in your daily life consistently.

What do you learn in personal finance?

Personal finance studies help you maximize your financial resources while you plan for current needs and future goals. You learn to create budgets, manage debt, build savings, and make smart investment decisions. These financial planning skills are essential for achieving financial stability.

Financial planning serves as the foundation of personal finance knowledge. This ever-changing process needs regular monitoring and usually follows five main steps:

- Assessment: Looking at your current financial situation (financial status assessment)

- Goal setting: Setting short and long-term financial objectives

- Plan creation: Creating strategies to reach those goals

- Execution: Following your financial plan with discipline

- Monitoring: Checking progress and making changes

Personal finance education teaches you to spot good and bad financial advice—an essential skill in today’s information-rich world.

How personal finance affects your daily life

Money touches almost every part of your life. Financial wellness associates strongly with good physical and mental health. Financial stress puts both at risk.

Research shows people with debt problems face higher risks of depression and suicidal thoughts. Studies prove an extra $5,000 per year can extend your life and improve your health. These findings highlight the importance of learning how to deal with financial stress and developing effective financial stress management techniques.

Money shapes major life decisions:

- Where you live (housing choices)

- What career you pursue

- Your education options

- How you spend leisure time

- How you handle emergencies

Your childhood experiences shape your money beliefs that can limit you as an adult. A 2024 survey reveals 47% of American adults say money causes stress and anxiety that hurts their mental health. Recognizing financial stress symptoms is the first step in overcoming financial stress.

Lifestyle and finances work together. Your spending habits shape your future financial health. Your financial capacity determines what lifestyle you can have. Regular exercise might lower your healthcare costs as you age.

Personal finance knowledge helps you balance today’s enjoyment with tomorrow’s preparation. Taking control of your finances gives you freedom to make choices based on your values instead of money pressure.

Break it down: the core parts of your financial life

“Do not save what is left after spending, but spend what is left after saving.” — Warren Buffett, Chairman and CEO of Berkshire Hathaway, legendary investor

Money management breaks down into five simple building blocks. Let’s see how these pieces create your complete financial picture.

Income: where your money comes from

Money coming in shapes all your financial decisions. Americans earn about $53,490 yearly before taxes, which leaves around $3,564 monthly after deductions. This cash usually comes from several places:

- Primary employment – Salaries, wages, overtime pay, bonuses, commissions, and tips

- Self-employment – Freelance work, business ownership, gig economy jobs

- Passive income – Rental properties, royalties, dividends from investments

- Government assistance – Social Security, disability benefits, unemployment

Financial stability starts when you understand your total income picture. Most money experts suggest creating multiple income streams to build security and create more opportunities. Conducting a thorough income assessment can help identify additional income sources.

Spending: where your money goes

Your spending habits directly shape your wealth-building potential. Your expenses typically fall into two categories:

Fixed expenses stay the same each month and need big lifestyle changes to adjust:

- Mortgage or rent payments

- Car payments and insurance

- School tuition or daycare

- Utilities

Variable expenses give you more control over your spending:

- Groceries and dining out

- Clothing and personal care

- Entertainment and travel

- Technology

Monthly budgets help you track your spending. Start with your essential needs – housing, food, utilities, and transportation. These make up your “Four Walls” – the financial priorities that protect your lifestyle. Effective expense tracking is crucial for maintaining a healthy financial status.

Saving: building a safety net

Savings protect you from life’s unexpected challenges. Without a financial cushion, small surprises can throw you off track and create debt.

Money experts suggest keeping 3-6 months of living expenses as an emergency fund. This safety net helps if you lose your job, face medical bills, or need urgent home repairs.

New savers should start small:

- Save your first $500

- Move up to $1,000, then $2,500

- Keep going until you reach your full emergency fund

High-yield savings accounts or money market accounts make great spots for emergency money. They’re FDIC-insured up to $250,000 and give you easy access to your cash.

Investing: growing your money

Investing helps your money grow beyond what savings alone can do. Time and compound interest turn small regular investments into significant wealth.

Here’s a real example: If you invest $3,000 yearly for 40 years and earn 6% on average, you’ll end up with $492,143 – that’s $120,000 from you plus $372,143 in earnings.

Match your investment style to your goals and comfort with risk. Common investments include:

- Stocks – Ownership shares in companies

- Bonds – Loans to companies or governments

- Mutual funds/ETFs – Professionally managed collections of investments

Index funds or ETFs that track the broader market often work best for newcomers.

Protection: keeping your finances safe

Good protection strategies shield your money from unexpected risks. They stop single events from wiping out your progress.

You need these key protections:

- Insurance coverage – Health, life, auto, home/renters policies

- Emergency savings – Ready cash for unexpected costs

- Legal protections – Wills, trusts, proper asset titling

- Debt management – Keeping high-interest debt in check

One medical emergency, lawsuit, or natural disaster could erase years of careful planning without proper protection. Insurance plays a crucial role – your insurance company handles claims instead of you paying directly.

These five pieces work as one complete system. Income drives spending and saving, saving enables investing, investing builds wealth, and protection keeps everything secure.

Build your plan: how to take control of your money

You need a well-laid-out plan to take control of your money. A properly organized financial system will give you a clear path to reach your financial dreams.

Creating a monthly budget

A solid budget forms the base of any financial plan. Calculate your net income—what you take home after taxes and deductions. Then track where your money goes by sorting expenses into needs (housing, utilities, transportation), wants (dining out, entertainment), and savings/debt payments.

Your personality helps determine which budgeting techniques work best:

- Envelope budget: Give specific amounts to expense categories and stop when they’re empty

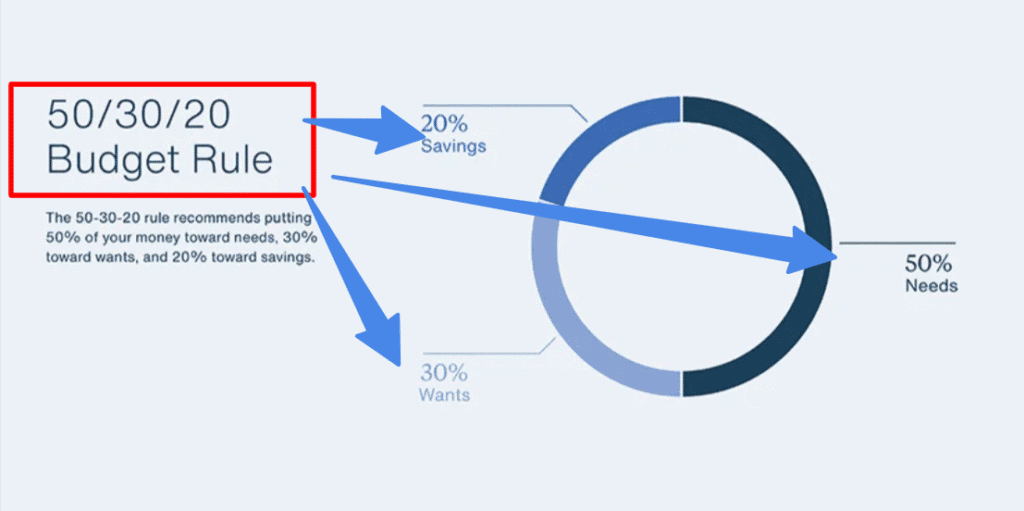

- 50/30/20 budget: Put 50% toward needs, 30% to wants, and 20% to savings and debt repayment

- Zero-based budget: Assign every dollar a job until you hit zero

- Pay-yourself-first budget: Save money before paying bills

Note that budgeting isn’t about limiting your spending—it’s about planning to achieve your financial goals. Budget creation is a crucial step in developing strong financial literacy.

Setting realistic financial goals

Your financial plan should start with what matters most to you. Write down your goals and rank them from highest to lowest priority.

Break down your objectives by timeframe:

- Short-term (6 months to 5 years)

- Mid-term (5 to 10 years)

- Long-term (10+ years)

Your goals should be SMART: Specific, Measurable, Achievable, Realistic, and Time-bound. Rather than saying “I want to save more,” try “I will save $30,000 for a house down payment in five years by setting aside $500 monthly”.

Small steps work too. If you aim to put 10% in your 401(k), start with 3% and add 1% each month until you reach your target.

Choosing the right tools and apps

The right tools make money management easier. Here are some options:

Spreadsheets let you control and customize everything. Software like Quicken helps track complex situations with investments or small businesses.

link to your accounts, sort transactions, and help you learn about your spending. Pick an app that matches your style—do you like detailed tracking or prefer to set it and forget it?Budgeting apps

Price shouldn’t be your only factor. Free versions work well, but paid options with better features might be worth it if they boost your financial outlook by a lot.

Tracking your progress

Your plan stays on course with regular monitoring. Look at your budget monthly or quarterly. These reviews help you compare actual versus planned spending and spot areas that need changes.

Life changes affect your finances—you might get a raise, face new costs, or hit your goals. Look at your plan yearly or when big life changes happen.

Long-term financial planning needs both net worth growth tracking and the right mix of assets. This approach helps build wealth while keeping the balance that fits your needs.

Avoid common mistakes and money traps

Your financial success depends on steering clear of common personal finance problems that can throw you off track. Small errors add up over time and create serious setbacks to your financial health.

Living beyond your means

People who spend more than they earn create a dangerous cycle. Research shows that even those with high incomes end up living paycheck to paycheck because of lifestyle inflation.

“Lifestyle creep” happens as you increase spending with higher income instead of saving more. This shows up in unnecessary purchases—name-brand items, new cars, or luxury goods that feel deserved but hurt your long-term financial security.

Warning signs include:

- Using credit cards for everyday expenses

- Having almost nothing left when the month ends

- Making only minimum payments on debts

- Taking loans to maintain your lifestyle

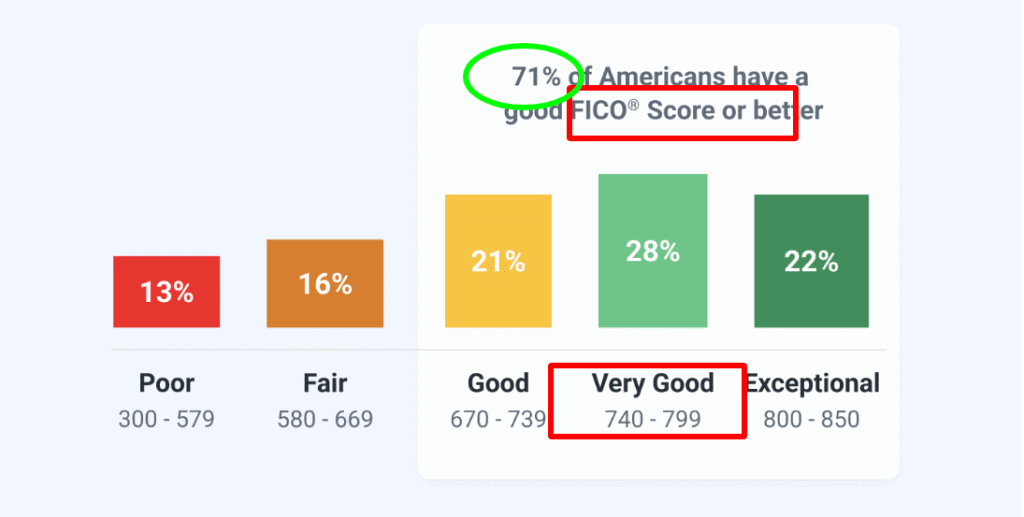

Ignoring your credit score

Your credit score affects much more than loan approvals. It changes what you pay for insurance, rental applications, job opportunities, and utility deposits.

Credit scores range from 300-850, and scores above 670 are “good”. Poor scores mean higher interest rates that could cost you thousands more over your loan’s lifetime.

A healthy score needs on-time bill payments, credit use below 30%, and regular checks of your credit reports for mistakes. Managing credit card debt is crucial for maintaining a good credit score.

Not saving for emergencies

Life without emergency savings means small financial surprises can knock you off course and create lasting debt. Most experts suggest saving 3-6 months of expenses. Start small if you need to:

First, save $500-$1,000 Then build up to one month of expenses Finally, reach your full emergency fund goal

Keep these funds in an available account that won’t lose value—like a high-yield savings account or money market fund.

Falling into high-interest debt

Debt with high interest—usually above 8%—becomes harder to escape as time passes. Credit cards, payday loans, and some personal loans charge between 15% and 30%.

The math works against you as interest compounds faster. A $5,000 credit card balance with minimum payments takes over two years to clear and costs more than $6,000 total.

Make high-interest debt your top priority while avoiding new debt at all costs. Consider debt consolidation options if you’re struggling with multiple high-interest debts.

Think long-term: how to grow and protect your wealth

“Financial freedom is available to those who learn about it and work for it.” — Robert Kiyosaki, Author of ‘Rich Dad Poor Dad’, entrepreneur, and personal finance educator

Planning ahead builds lasting financial security. Today’s financial choices shape your future for decades to come.

Why retirement planning starts now

Time works as your greatest ally when saving for retirement. Early starts let your money grow through compound interest. Small but steady contributions can make a huge difference in your retirement fund as time passes.

Most people put off retirement planning because they focus on immediate money needs. Waiting just 10 years could cut your potential retirement savings by half. Monthly investments of $200 starting at age 25 with a 7% annual return could grow to $500,000 by age 65. The same investment starting at 35 would only reach $250,000.

Understanding insurance needs

Your financial plan needs insurance as its safety net. Good coverage protects everything you’ve built against unexpected risks, beyond just planning for worst cases.

You need protection through:

- Health insurance to cover medical expenses

- Life insurance to replace income

- Disability insurance to protect earnings during inability to work

- Long-term care insurance as you age

Disability insurance remains one of the most overlooked coverage types, yet it plays a vital role during peak earning years.

How taxes affect your money

Smart tax planning helps your wealth grow substantially. Tax-advantaged accounts like 401(k)s and IRAs reduce your taxable income while building retirement savings.

Broaden your tax exposure through both traditional (pre-tax) and Roth (after-tax) accounts. This approach helps manage future tax uncertainty and works well if you have concerns about risk.

Teaching your kids about money

Money lessons begin at home. Kids learn their money habits from parents between ages 6-12. Teaching your children creates skills that benefit everyone, even if your own money habits need work.

Begin with age-appropriate lessons about earning, spending, saving, and giving. Younger kids respond well to labeled jars or piggy banks with three slots for give, save, and spend money. Older children can learn about investing and using credit responsibly. This early financial literacy education can set them up for future financial success.

Conclusion

You can’t take control of your personal finances overnight. It takes small, considered steps that build upon each other. We’ve broken down what might seem overwhelming into manageable pieces anyone can tackle.

Financial wellness impacts every part of your life. Your physical health, mental wellbeing, and daily happiness tie directly to your financial situation. Understanding the simple concepts—income management, smart spending, consistent saving, strategic investing, and proper protection—gives you control over your financial future.

Begin wherever you are now. This could mean creating your first budget or building a $500 emergency fund. You might need to review your retirement contributions or teach your children about money. The goal isn’t perfection but progress.

Personal finance remains 20% knowledge and 80% behavior. You probably know more than you think about managing money. The challenge comes from applying what you know consistently. Each positive financial decision builds stronger habits and brings you closer to your goals.

Your financial experience will have obstacles. Economic downturns, unexpected expenses, or moments of weakness might temporarily derail your progress. With proper planning and protection measures, these setbacks become manageable bumps rather than catastrophic roadblocks.

Five years from now, you’ll wish you had started today. A decade from now, you’ll be grateful you did. Financial freedom creates opportunities that arrange with your values and dreams—whether that means traveling, changing careers, starting a business, or enjoying life without money stress.

Personal finance ended up giving you something priceless: options. Managing your money effectively creates space to live life on your terms. That freedom shows the true value of taking charge of your personal finances.

FAQs

Q1. What are the key components of personal finance?

Personal finance consists of five main areas: income (money you earn), spending (how you use your money), saving (setting aside funds), investing (growing your wealth), and protection (safeguarding your assets).

Q2. How can I create an effective budget?

Start by calculating your net income, then track your expenses by categorizing them into needs, wants, and savings/debt payments. Choose a budgeting method that suits you, such as the 50/30/20 rule or zero-based budgeting, and regularly review and adjust your budget as needed.

Q3. Why is it important to start retirement planning early?

Starting retirement planning early gives your money more time to grow through compound interest. Even small, consistent contributions can significantly impact your retirement fund over time. Delaying retirement savings by just a decade can potentially cut your retirement savings in half.

Q4. How can I avoid common financial mistakes?

To avoid financial pitfalls, live within your means, pay attention to your credit score, build an emergency fund, and avoid high-interest debt. Be mindful of lifestyle inflation as your income grows and focus on increasing your savings rate instead.

Q5. What role does insurance play in personal finance?

Insurance serves as a safety net for your financial plan. It protects what you’ve built against unexpected risks. Essential coverage includes health insurance, life insurance, disability insurance, and potentially long-term care insurance. Having proper insurance safeguards your finances from potentially catastrophic expenses.